Local taxes - are we contributing too much, not enough, or our fair share?

by Brian Kennedy and Dr. Patrick Jones

With all the construction now taking place around Spokane it's hard not to see tax dollars in action. Public projects are highly visible but certainly not comprehensive signs of government work, raising the question: What is our tax burden relative to the local governments around the state? Are we paying the "right amount" to government agencies? That may be a loaded question with a multitude of answers dependent on your political leanings. But what does the data show and how might they de-politicize certain questions? Indicator 2.2.8, municipal government revenue generated, attempts to do just that.

In 2016, all city municipalities within the county and the county government claimed a total of $404.6 million of revenue from local sources. The total is comprised of property taxes, retail sales taxes, B & O taxes, and other minor taxes and fees. Notably this indicator only measures the tax revenue generated within city and county jurisdictions.

The sum isn't a complete measure of the overall local taxes paid by county residents, however, as it doesn't include levies or bonds enacted by individual government departments and agencies such as fire districts and parks departments, or by school districts. As those are all handled differently by each jurisdiction and often cross municipal boundaries, it is extremely difficult to assign impacts. Nevertheless, this indicator does measure all those local taxes and fees that are core to local government operations, enabling statewide comparisons.

Of the $404.6 million in tax revenue in 2016, the largest contribution came from the property taxes with $167.3 million, or 41%, of the total taxes generated. Retail sales taxes, at $154.6 million, or 38% of total, followed. The remaining 21% is consisted of B & O taxes along with other less substantial taxes such real estate excise taxes or fees associated with unpaid taxes.

This breakdown of tax revenue generally holds true statewide as well, with property taxes making up just over 43% of total local tax revenue and sales taxes coming in around 34%. The four-percentage point difference in retail sales tax revenue between the shares of Spokane County and all local governments in the state can largely be attributed to the growth in County retail sales. Spokane's slightly lower property tax take compared to the State has been driven in part by surging home values on the west side. In addition to this, the gap is likely to have widened further in 2017 due to the county retail sales outpacing the state in the final three quarters of 2017.

Observing the path of the annual growth rate of assessed value of taxable property clearly shows why the state has a larger share of taxes generated from property values. Indicator 2.3.1 depicts and annual growth rate of Washington State at 8.1%, Spokane County sits at just 5.5% for 2016. Since 2013 the tax take by municipal governments across the state have outpaced the County, with a gap in the property tax growth rates as much as 5.6 percentage points.

It bears mentioning, however, that the retail sales tax portion of the data cannot be directly attributed to Spokane County residents. As Spokane is a retail hub for many of the smaller cities throughout Eastern Washington and Northern Idaho, some of that tax revenue is collected from individuals outside the county. However, there is no way of knowing what level these tourists contribute. And of course, other counties may profit from out-of-county spending as well.

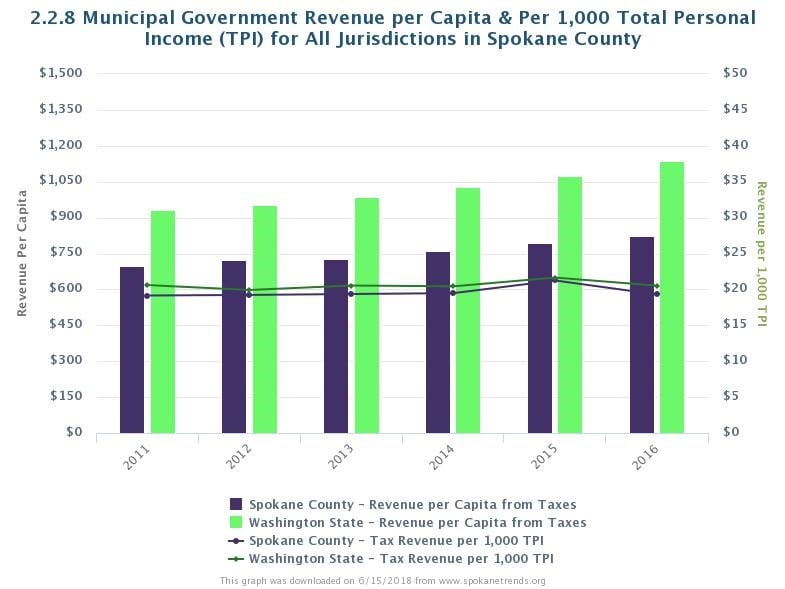

So much for the totals behind the graph. Comparisons to municipal governments across the state can be done in two ways. The first is the per capita approach. How much does the average person pay in local taxes going to local governments? In 2016 in Spokane, this amounted to $821, increasing by an average of 3.3% each year since 2011. This has slightly outpaced per capita personal income by just 0.3 percentage points, data of which can be found on Indicator 2.1.2.

The 2016 value for Spokane is still quite a bit lower than local governments statewide, which reported average of $1,136 per capita of tax revenues generated. Since 2011, State per capita personal income had a cumulative annual growth rate of 4.3%, which was 0.2 percentage point faster than the growth rate of the per capita taxes generated of 4.1%. This indicates that local governments around the state have collected considerably more taxes from their residents than Spokane. But statewide incomes have increased at a faster rate, offsetting any additional burden.

While per capita measures provide one comparison, they don't necessarily take into account differing incomes between the County and the State. Observed in the graph above, Spokane County residents reported per capita personal income of roughly $42,000 in 2016, about $12,500 lower than that of the State. With that large a difference, a wide gap in tax revenue generated per capita will naturally occur, since higher incomes usually lead to higher levels of expenditures on local government services.

The second measure on indicator 2.2.8 makes adjustments for this income discrepancy. It measures local government expenditures on the basis of $1,000 of personal income. In this way, moderate income and high-income municipalities can be compared. In 2016, for every $1,000 in income claimed by a Spokane County resident, $19.30 was sent to the city and county coffers. This is just shy of 2% of all income generated and this trend has been nearly unchanged since 2011.

This share is nearly in unison with the State. In 2016, the same measure for all municipal government across the state was just $1.2 higher, sitting at $20.5 in taxes generated per $1,000 in personal income. On a per capita basis, Spokane County residents have generated quite a bit less in local tax revenues, but once taxes have been adjusted for income, the out of pocket costs are roughly the same.

Al French, Spokane County Commissioner, commented: "Yes, it (indicator 2.2.8) confirms what I suspected and what our staff discovered as well. The other way to look at the numbers is that our citizens are getting a full set of services at a lower price than what our peers are delivering which reflects our level of efficiency."

So, are Spokane County residents overly burdened by taxes? Again, that's a policy discussion to be had another day, based, in part, on what is an acceptable burden. This indicator reveals simply that Spokane County residents may be contributing less on average per person to local taxes than their counterparts across the state. But their out of pocket contributions are roughly on par with the state average.